AGN Offering T4 Trading Software

T4 software

Trade Futures and Options products on the major Exchanges Worldwide

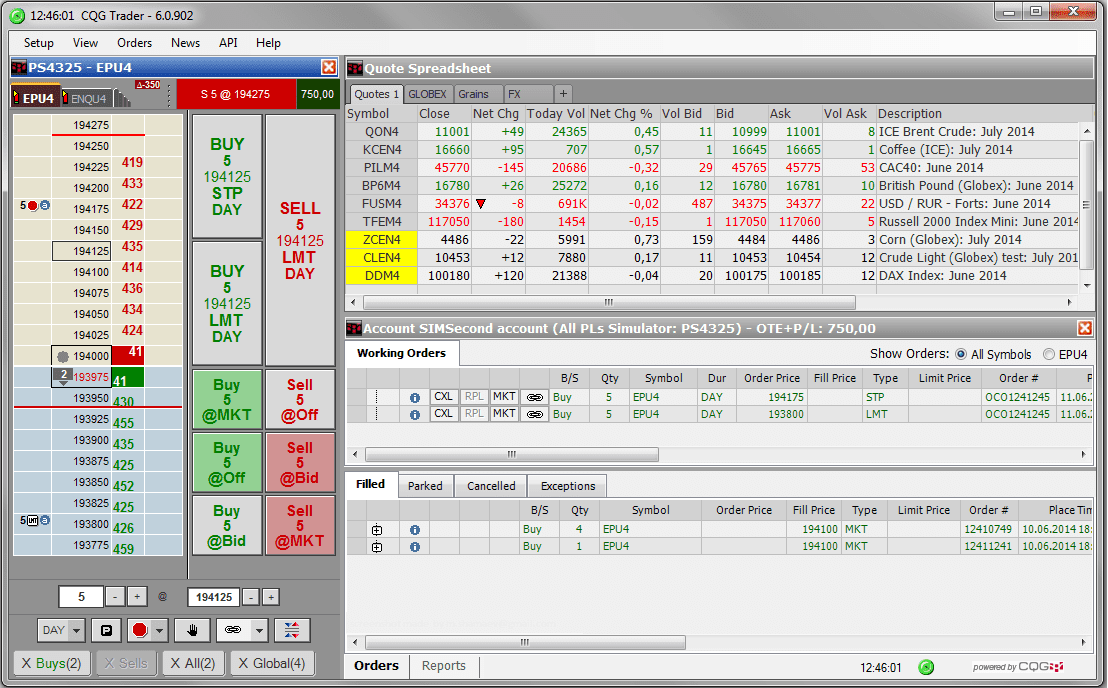

EXECUTION

Direct exchange access provides fast, reliable quotes directly from the exchanges you want to participate in. Fast clean market data is a key component for your successful trading. All order routing is direct from our robust data center to the exchanges. Latency is minimized so you have the best chance to execute your trading strategies. An abundance of professional trading tools allows you to build the perfect workspace for how you trade.

ORDER TYPES

CTS T4 offers a wide variety of order types. You can start with the basics like limit, stop, and market orders. Then you can turn to OCO, auto OCO, and also create your own multi-bracket order templates. Icebergs, MOC, GTC and others are also available. All orders are held server-side in our network or immediately sent directly to the exchange. Flatten positions, flatten and cancel, or just cancel working orders with one click.

- Trailing orders

- Time types include GTC and FAK

- Price types include limit, market, stops, MIT, hit, and join

- Activation based on market mode, time, price, and bid/offer price and volume

- Max show (iceberg) orders

- OCO, auto OCO, bracket, batch, and MOC orders

- Queue orders

- RFQ

T4 Mobile for Android, iPhone, iPad, and iPod touch

A simple trading interface that utilizes touch screen technology. T4 Mobile offers real-time market access to every exchange CTS offers, real-time order submission, and a back-end that offers extreme reliability. T4 Mobile is available for Android, iPhone, iPad, iPod touch, all Android devices, and in web browsers as T4 WebTrader.

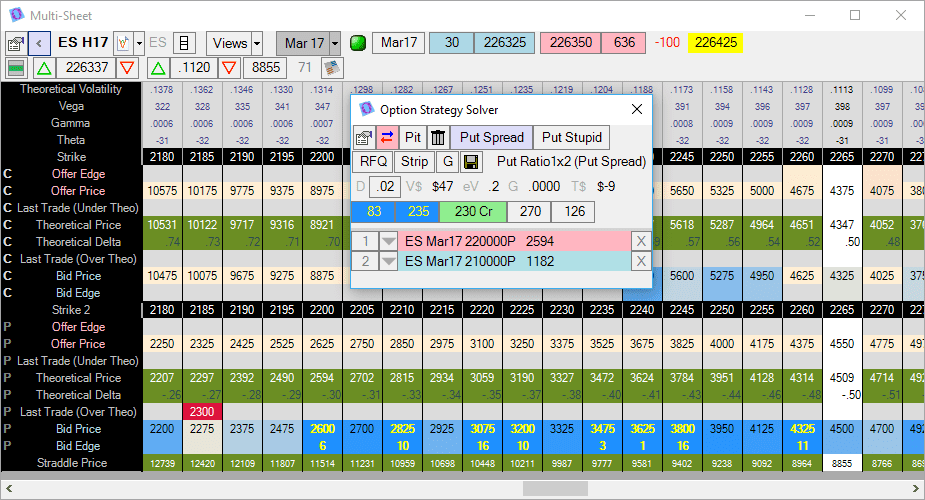

Options Trading

All CTS products allow you to view and execute all exchange supported option outrights and spreads. View option chains and strategies in straightforward formats from our desktop application. When you find the right option, just click on it to open a new order ticket, depth of market, chart, and more. Options Pro builds upon the innate functionality listed above to create a comprehensive professional options package. Use different option models to create custom volatility skews, from which we automatically build theoretical pricing and delta sheets. Pick and choose which Greeks you want to monitor, build and value custom spreads in real time, and execute trades confidently. Heat maps provide a quick visual confirmation of advantageous trades, while a portfolio analysis tool ensures you don’t overlook the big picture.