The Small Exchange

A New Way to Trade Equities, Commodities & Forex

The Small Exchange is making markets more accessible to more people with products that mix the efficiency of futures with the simplicity of stocks. Built on the pillars small, standard and simple, the Smalls offer easily adoptable solutions to risk management and speculative needs of the modern trader in markets ranging from stocks and bonds to currencies and commodities.

Products on The Small Exchange

Small Stocks 75 (SM75)

Small Precious Metals (SPRE)

Small Dollar (SFX)

Small Global Oil (SMGO)

Coming Soon

Small 10YR Treasury Yield

Coming Soon

Diversification and Trading

Coming Soon

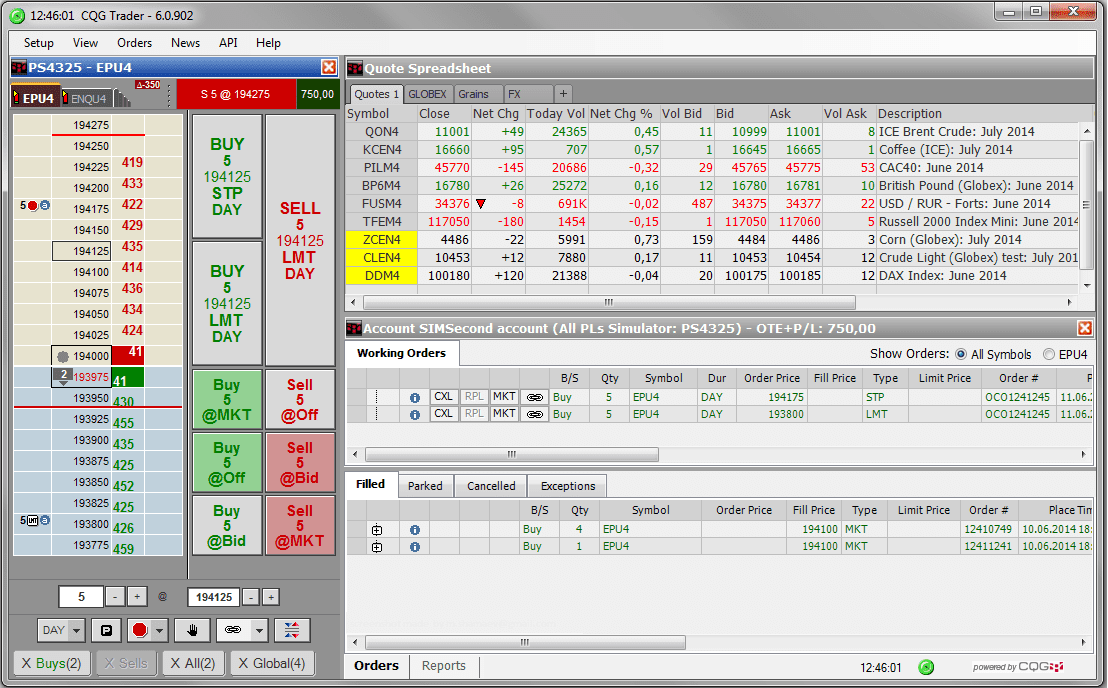

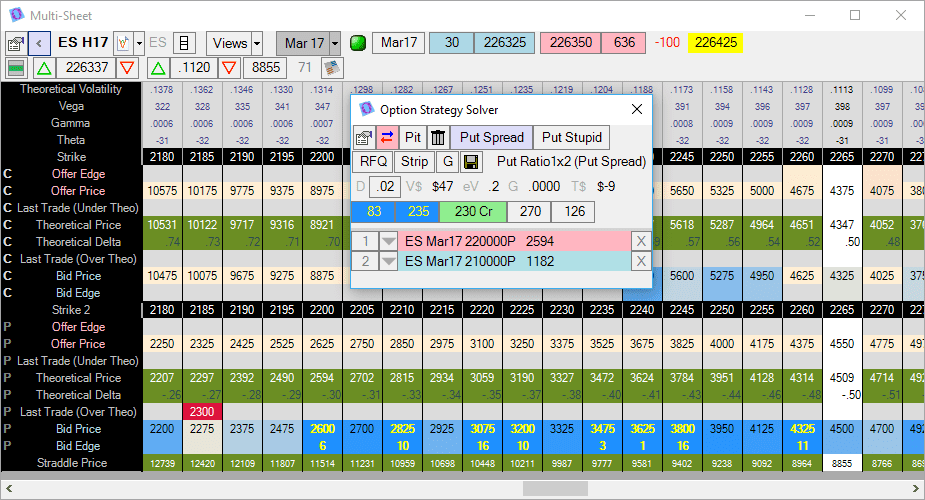

Trading the Smalls

The contracts are Small – By reducing the size of products, traders can manageable capital efficiency.

The contracts are Standard – All the Smalls share the same tick size and expiration date. No more worrying about tick size, multiplies, or expectations. Learn them once, not by each specific product.

No market data fees – The ability to trade the Small Exchange futures without having to purchase market data.

Universal to all Small Exchange Products

Settlement: Cash-settled

Daily Limits 20%

Intraday Limits 7% 13%

Margin

SM75/Small Stocks 75

Initial: $495 Maintenance: $450

SPRE/Small Precious Metals

Initial:$225 Maintenance: $205

SFX/Small US Dollar

Initial:$159 Maintenance:$145

*Disclaimer: The above information was obtained from a third party source and thought to be reliable. Product size and margin requirements are subject to change daily. No guarantee is made. AGN Futures LLC, accepts no responsibility for any errors or omissions.