Trading Software

Futures & OptionsTrade Futures and Options products on the major Exchanges Worldwide

Execution, Support, and Research

Desktop

Download T4 to your PC

Custom Chart Builder

Advanced charting

Mobile

Available for Android, iPhone and iPad

EXECUTION

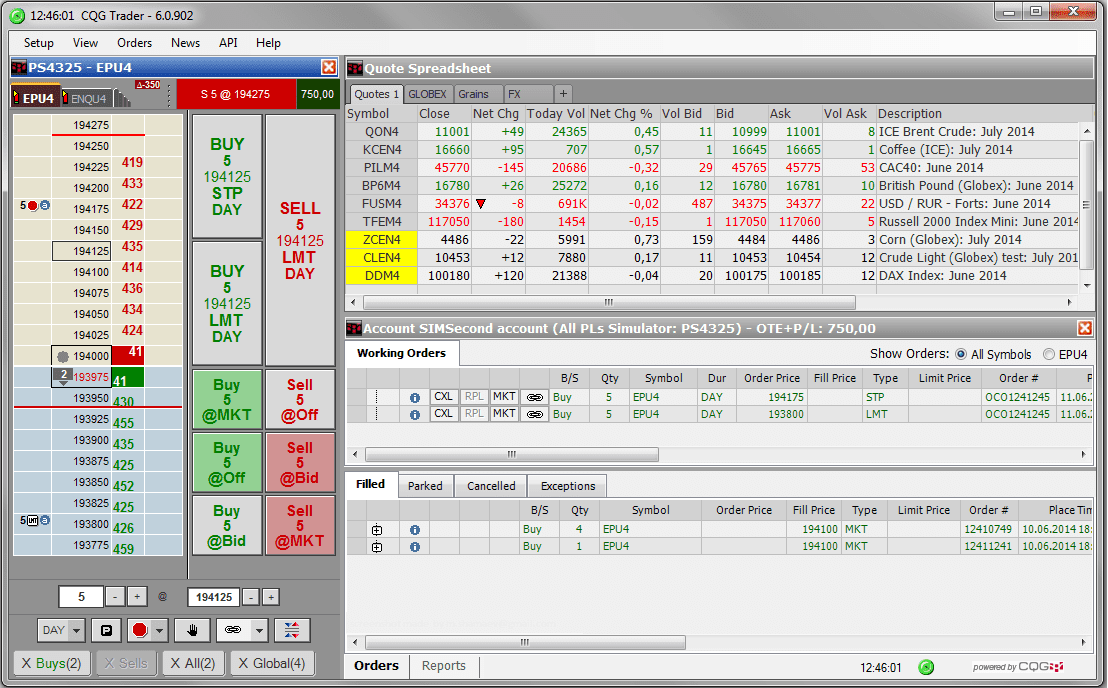

Direct exchange access provides fast, reliable quotes directly from the exchanges you want to participate in. Fast clean market data is a key component for your successful trading. All order routing is direct from our robust data center to the exchanges. Latency is minimized so you have the best chance to execute your trading strategies. An abundance of professional trading tools allows you to build the perfect workspace for how you trade.

ORDER TYPES

CTS T4 offers a wide variety of order types. You can start with the basics like limit, stop, and market orders. Then you can turn to OCO, auto OCO, and also create your own multi-bracket order templates. Icebergs, MOC, GTC and others are also available. All orders are held server-side in our network or immediately sent directly to the exchange. Flatten positions, flatten and cancel, or just cancel working orders with one click.

- Trailing orders

- Time types include GTC and FAK

- Price types include limit, market, stops, MIT, hit, and join

- Activation based on market mode, time, price, and bid/offer price and volume

- Max show (iceberg) orders

- OCO, auto OCO, bracket, batch, and MOC orders

- Queue orders

- RFQ

T4 Mobile for Android, iPhone, iPad, and iPod touch

A simple trading interface that utilizes touch screen technology. T4 Mobile offers real-time market access to every exchange CTS offers, real-time order submission, and a back-end that offers extreme reliability. T4 Mobile is available for Android, iPhone, iPad, iPod touch, all Android devices, and in web browsers as T4 WebTrader.

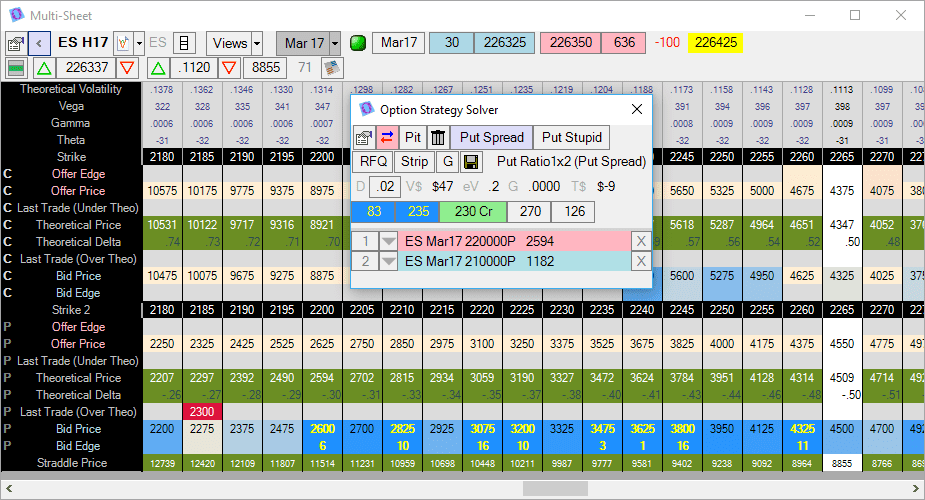

Options Trading

All CTS products allow you to view and execute all exchange supported option outrights and spreads. View option chains and strategies in straightforward formats from our desktop application. When you find the right option, just click on it to open a new order ticket, depth of market, chart, and more. Options Pro builds upon the innate functionality listed above to create a comprehensive professional options package. Use different option models to create custom volatility skews, from which we automatically build theoretical pricing and delta sheets. Pick and choose which Greeks you want to monitor, build and value custom spreads in real time, and execute trades confidently. Heat maps provide a quick visual confirmation of advantageous trades, while a portfolio analysis tool ensures you don’t overlook the big picture.

Web Trader

- $0.50 per contract capped at $500

- 1 Depth Window

- 1 Quoteboard with 5 Tabs

- 6 Simultaneous Market Subscriptions

- Account Board for 1 Account at a Time

- Order Book for 1 Account at a Time

- Order Ticket

- Pull All Button

- Statements (Where Available)

- Historical Order Book and Reports

- Market, Limit, Stops, GTC, and Trailing Orders

Core Pricing

first 50 contracts free- $0.50 per contract $500 cap

- All WebTrader Benefits

- Android app access

- iPhone, iPad, and iPod touch app access

- 30+ Depth Windows

- Multiple Quoteboards and Tabs

- 500 Simultaneous Market Subscriptions

- Account Board for Multiple Accounts

- Order Book for Multiple Accounts

- Advanced Order Types and Order Templates

- Charts with 1 Minute Bars and Up

- 50+ Chart Studies and Indicators

- Chart Trading

- Option Strategies Board

- Multiple Monitor Support

- Access to add-ons: Options Pro, TradeSniper®, Market Profile, and Time Entry

- .Net API, FIX API, and DDE functionality

Advanced

first 400 contracts free- $0.50 per contract $500 cap

- All Core Benefits

- 2500 Simultaneous Market Subscriptions

- Spread Matrix

- Tick Charts

- All Available Chart Studies

- Custom Chart Study Scripting

- Custom Session Times

- Overlay Second Contract on Charts

- Studies on Studies

- Breaking News Stories

- Economic Indicators

- Contract History with “All” and “All+Related” Tabs

- Preferential Servers

Market data fees are not included above. The Fees mentioned above will be applied as a transaction fee. All numbers shown above should be considered estimates. Commission, Transaction, Exchange and NFA fees apply to all filled orders. Fees are subject to change.